What Is FinOps?

FinOps is more than just a process; it’s a cultural shift that brings together various teams across an organization—such as finance, operations, and engineering—to effectively manage cloud-related costs. By implementing FinOps, businesses can monitor their expenses in real time, enabling informed decisions that optimize resource usage. This collaboration ensures that all stakeholders understand their cloud spending, promoting responsible use of cloud resources.

The Core Principles

Understanding the fundamental principles of FinOps helps organizations streamline their cloud usage. These principles include:

- Cost Efficiency: Avoid over-provisioning and reduce wasted resources. By analyzing usage patterns, businesses can adjust their cloud infrastructure to match actual demand, leading to significant savings.

- Accurate Budgeting: Improve predictions and reduce surprises in monthly bills. With real-time monitoring, finance teams can forecast budgets more effectively and allocate funds where needed.

- Collaboration Efficiency: Bring finance and tech teams together for smarter decisions. When everyone understands the financial implications of their actions, it leads to better resource allocation.

- Adaptability: Quickly adjust your cloud setup based on your business’s current needs. FinOps allows organizations to scale resources up or down efficiently, adapting to market changes or internal demands.

These principles allow businesses to achieve maximum value from cloud investments while ensuring they only pay for what they need.

Key Benefits of Implementing financial operations

When FinOps is integrated into your cloud strategy, it provides several advantages:

- Cost Savings: Optimize cloud usage to reduce over-provisioning and identify underutilized resources.

- Better Budget Forecasting: Improve financial forecasting and eliminate surprises in your cloud bills.

- Operational Efficiency: Increase collaboration between teams, leading to better decision-making.

- Business Agility: Make faster adjustments to cloud infrastructure based on current business needs.

The Lifecycle: A Step-by-Step Approach

The FinOps lifecycle is a dynamic process that helps organizations manage, optimize, and operate cloud costs effectively. By breaking down the journey into three key phases—Inform, Optimize, and Operate—teams can gain better control over their cloud spending while continuously improving financial efficiency. Let’s dive into each phase and how it works in practice.

A typical FinOps lifecycle involves three phases:

1.Inform: Understanding Cloud Expenses

The first step in the FinOps lifecycle, Inform, is all about gaining visibility into your cloud expenses. Teams leverage detailed billing reports and dashboards to get a clear picture of where the money is being spent across different cloud services. This stage is crucial because it creates awareness within the organization about cloud spending patterns, which often go unnoticed without proper tools and processes in place.

For instance, you may discover that certain departments or projects are consuming more resources than anticipated, or that some cloud services are underutilized, leading to inefficiencies. The goal here is to bring transparency to cloud costs, enabling stakeholders to understand how resources are being used and to start identifying areas where savings can be achieved.

2.Optimize: Reducing Unnecessary Cloud Expenditures

Once there is clarity on cloud spending, the next phase, Optimize, focuses on cutting down unnecessary costs and improving overall efficiency. This is where teams dive into cost optimization strategies such as:

Rightsizing instances: Adjusting the size of your cloud instances to better match the actual workload, preventing over-provisioning and wasted resources.

Utilizing Reserved instances/Savings plan: Committing to long-term usage of services like EC2 through reserved instances or Savings Plans to benefit from significant cost savings.

Deleting Idle Resources: Identifying and removing unused or idle resources, such as unattached storage volumes or inactive instances, that continue to incur costs without providing value. This practice ensures that you are only paying for the resources actively supporting your operations.

The Optimize phase requires collaboration between finance, engineering, and operations teams to find and implement the best strategies for maximizing cost savings without sacrificing performance or productivity.

3. Operate: Sustaining Cost Efficiency with Governance

The final phase, Operate, is all about maintaining ongoing control over cloud costs by establishing strong governance policies. It’s not enough to optimize once; you need processes and guidelines in place to ensure that cost efficiency is continuously achieved.

This phase includes implementing rules around resource usage, automating cost-saving practices (like turning off unused instances), and maintaining a culture of financial accountability. Governance also means setting up regular check-ins or reviews to ensure teams remain aligned with FinOps principles and that new cloud expenditures are consistently evaluated for cost-effectiveness.

The goal of the Operate phase is to embed cost management into your daily cloud operations, ensuring that everyone in the organization takes ownership of their cloud spending and contributes to ongoing financial efficiency. By following these steps, businesses can maintain a balance between cost and performance.

The FinOps lifecycle—Inform, Optimize, and Operate—creates a structured approach to managing cloud costs that evolves with your organization. By gaining insight into spending, actively reducing waste (like idle resources), and maintaining cost control over time, businesses can maximize the value of their cloud investments while staying financially efficient in the long run.

Best Practices for Effective Financial operations

To ensure your financial operations run smoothly and efficiently in the cloud, it’s essential to adopt a structured approach. By implementing these best practices, you can optimize costs, promote accountability, and maintain control over your cloud spending. Let’s explore each in more detail :

1. Assign Accountability

One of the most important steps in cloud financial management is assigning cost ownership to specific teams or individuals. This practice creates accountability, ensuring that someone is responsible for tracking cloud expenditures, identifying potential savings, and optimizing usage. When teams or departments are directly accountable for their cloud costs, they are more likely to take an active role in monitoring their consumption, making informed decisions, and staying within budget. This approach not only fosters a cost-conscious culture but also promotes shared responsibility across the organization.

2. Automate Monitoring

Manually tracking cloud usage and costs can be time-consuming and prone to human error. That’s why automating the process is critical. Using tools like AWS Cost Explorer or Azure Cost Management, you can set up automated reports and dashboards that provide real-time insights into cloud usage and expenditures. These tools allow teams to track usage patterns, set custom alerts for unexpected cost spikes, and make necessary adjustments on the go. Automation minimizes the workload on teams and provides instant visibility, making it easier to stay within budget and react quickly to changes in usage.

3. Frequent Cost Reviews

Cloud environments are dynamic, and your resource needs will change over time. To keep costs in check, it’s essential to conduct frequent cost reviews. Regularly reviewing your cloud consumption and resource allocations ensures that you are only paying for what you need and using services optimally. During these assessments, teams can look for unused or underutilized resources, review pricing models to see if reserved instances or savings plans would be more cost-effective, and make necessary adjustments. Regular reviews also help in identifying trends, enabling better financial forecasting and proactive adjustments.

4. Tag Resources

Properly tagging cloud resources is a foundational practice in cloud financial operations. Tagging involves assigning metadata to your cloud resources (such as virtual machines, databases, or storage), which helps organize and track them by project, department, or cost center. Effective tagging enables more accurate cost allocation, making it easy to see where your cloud budget is being spent. For example, you can analyze cloud costs by department to see which teams are driving expenses and whether any projects are exceeding their allocated budget. Proper tagging simplifies reporting and allows for deeper insights into cloud usage, making financial tracking and optimization much easier.

By following these best practices—assigning accountability, automating monitoring, conducting frequent cost reviews, and tagging resources—you can create a more efficient and effective financial operations strategy for managing cloud expenses. These steps help maintain cost transparency, optimize cloud spending, and ensure that all stakeholders stay aligned with your organization’s financial goals.

Tools for Cloud Cost Monitoring:

Using the right tools is crucial for a successful FinOps implementation. Many cloud providers offer built-in tools:

AWS Cost Explorer: Gaining Detailed Insights into Your AWS Cloud Spending.

AWS Cost Explorer is a powerful tool designed to help businesses understand, manage, and optimize their cloud spending. By providing detailed insights into your AWS usage, this tool enables you to track your costs over time, spot trends, and analyze patterns across various AWS services.

Whether you’re a startup keeping a close eye on your cloud budget or an enterprise managing large-scale infrastructure, AWS Cost Explorer offers a clear breakdown of how your resources are being consumed. You can dive deep into your cost data by filtering it by account, region, service, or even specific tags, allowing you to identify where your budget is being allocated and pinpoint areas that may need cost optimization.

One of the most beneficial features is its ability to visualize spending trends through easy-to-read graphs and reports. This makes it much simpler to spot irregularities, like unexpected cost spikes, which could signal over-provisioned resources or unoptimized configurations. It also allows for better forecasting of future costs based on historical data, so you can plan and budget more effectively.

Ultimately, AWS Cost Explorer is an essential tool for anyone looking to stay on top of their cloud spending. With its detailed breakdowns, trend analysis, and predictive capabilities, it provides the visibility needed to make smarter financial decisions and optimize your AWS cloud costs.

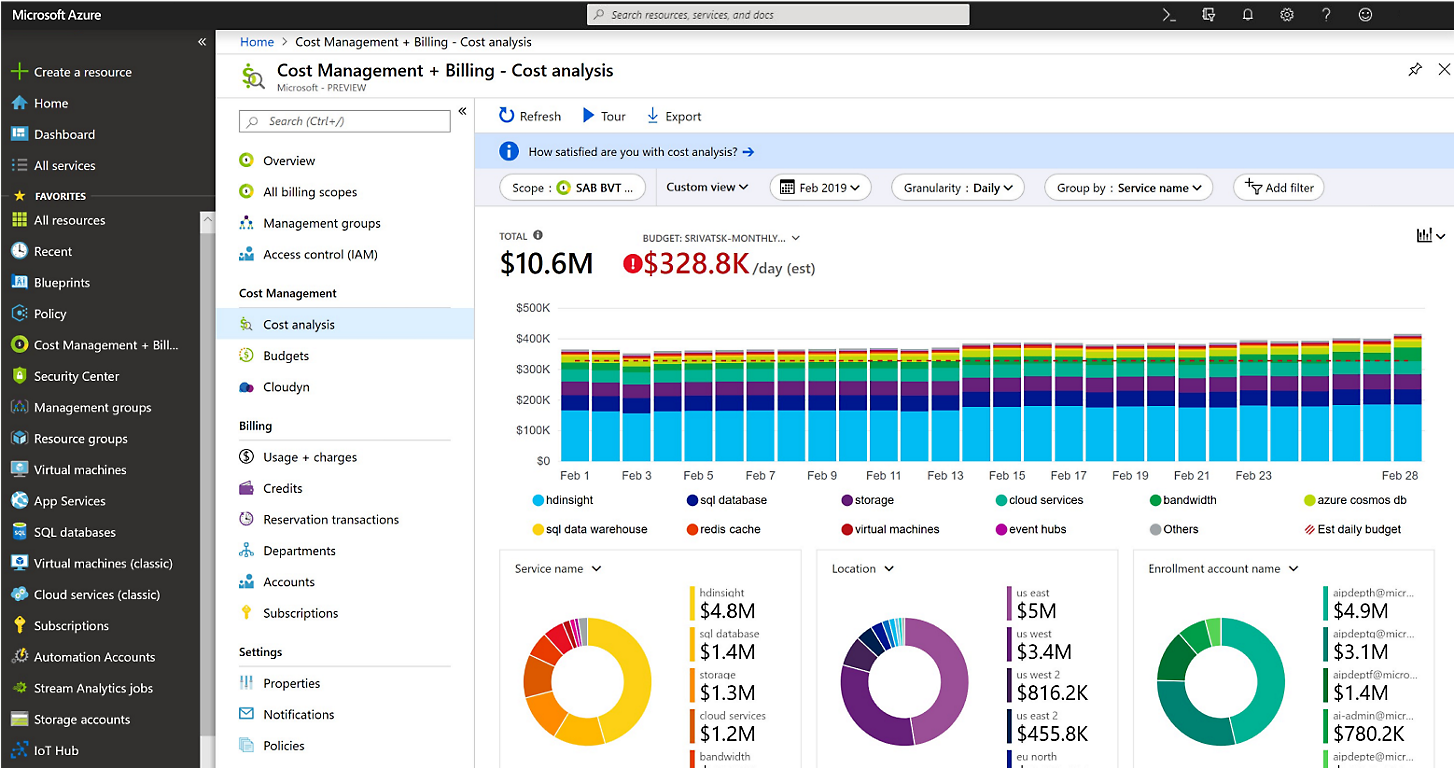

Azure Cost Management: Managing Costs and Optimizing Cloud Spending.

Azure Cost Management is an essential tool designed to help businesses efficiently manage their cloud spending on Microsoft Azure. With the growing adoption of cloud services, it’s easy for costs to spiral out of control if not properly monitored. Azure Cost Management provides visibility into your cloud usage and expenses, empowering organizations to make informed financial decisions and optimize their cloud investments.

One of the key features of Azure Cost Management is the ability to track and analyze your spending in real time. It allows you to break down costs by department, project, or resource, so you can pinpoint exactly where your budget is being allocated. This level of transparency makes it easier to identify areas of waste or underutilized resources, enabling you to take proactive steps toward cost reduction.

In essence, Azure Cost Management not only helps businesses track and manage their Azure costs but also equips them with the tools to optimize cloud spending. With its real-time insights, budgeting capabilities, and optimization recommendations, it’s an indispensable tool for any organization looking to maximize the value of its cloud investment while staying within budget.

Google Cloud Cost Management: Tracking and Managing Your Cloud Expenses.

Effective cost monitoring is crucial for organizations utilizing Google Cloud, as it helps maintain control over cloud expenses while ensuring optimal resource usage. Google Cloud Cost Management offers robust tools and features that provide real-time visibility into spending, allowing businesses to track their costs as they occur. By utilizing detailed dashboards and cost reports, organizations can identify spending trends and anomalies, enabling them to react quickly to unexpected increases in expenses. This immediate access to financial data is essential for maintaining budgetary discipline and preventing cost overruns.

Challenges in Adopting Financial operations

While FinOps offers significant benefits, businesses may face several challenges during adoption:

- Lack of Visibility: Teams may struggle to track expenses without real-time insights.

- Siloed Teams: Poor communication between finance, operations, and engineering teams can slow down decision-making.

- Complexity of Multi-Cloud: Managing multiple cloud providers increases the complexity of cost tracking and optimization.

Addressing these challenges requires strong collaboration and the right tools to unify cost management efforts.

Emerging Trends in FinOps

As cloud adoption continues to rise, several emerging trends are shaping the landscape of Financial Operations:

- Increased Automation: Organizations are leveraging automation tools to streamline cloud cost management. This reduces manual workload and ensures more accurate tracking of expenses.

- Cost Governance Frameworks: Businesses are establishing robust governance frameworks to enforce policies around cloud spending. These frameworks help ensure that all departments adhere to cost management guidelines.

- Cross-Departmental Collaboration: More companies are fostering collaboration between finance, engineering, and operations teams. This collective approach enhances transparency and drives more informed decision-making regarding cloud usage.

- Data-Driven Decision Making: Companies are increasingly using data analytics to inform their financial strategies. By analyzing usage patterns and costs, businesses can make strategic adjustments that align with their financial goals.

Conclusion

FinOps is a powerful framework for managing cloud costs effectively. By bringing together finance, operations, and engineering, businesses can achieve greater transparency, optimize spending, and ensure that cloud investments drive business growth. Start implementing FinOps today to unlock the full potential of your cloud infrastructure. For more assistance with AWS FinOps, you can reach out to TruCost.Cloud, where we specialize in optimizing cloud financial management.